While Hans Humes’ precise net worth isn’t public knowledge, his career as the founder and president of Greylock Capital Management offers valuable insights into his financial success. This profile piece delves into Humes’ journey, exploring his firm’s investment strategies and the likely scale of his wealth.

Humes’ Path to Finance: A Global Perspective

Humes’ international upbringing, beginning with his birth in Tokyo and subsequent exposure to diverse cultures and economies, likely shaped his worldview and interest in emerging markets. After earning a BA from Vassar College, he obtained an MBA from INSEAD, equipping him for a career in high finance.

Greylock Capital: Venturing into Emerging Markets

Humes founded Greylock Capital Management in 1999, specializing in emerging markets and distressed debt. This investment approach, akin to exploring uncharted financial territory, carries inherent risks but offers the potential for substantial returns. Greylock’s focus on these often-overlooked markets suggests Humes’ unique investment philosophy—seeking undervalued opportunities that others may miss.

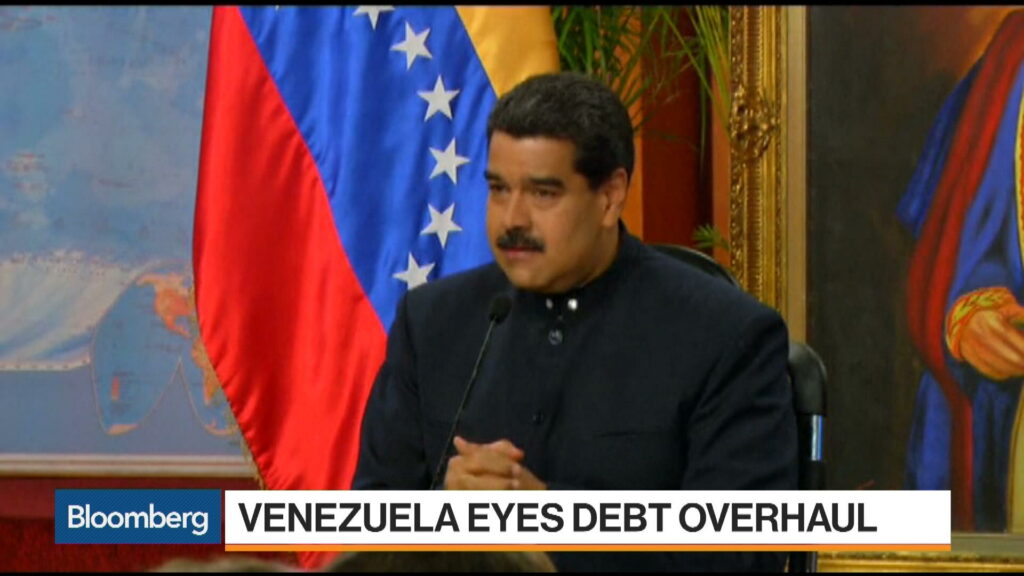

Distressed Debt: A High-Stakes Specialty

Humes is a recognized figure in sovereign debt restructuring, navigating the complexities of nations facing financial difficulties. His expertise in turning precarious situations into potentially profitable endeavors suggests significant financial acumen and likely substantial rewards.

Greylock’s Performance: Clues to Humes’ Success

While Humes’ personal financial statements are private, Greylock’s performance provides some clues about his financial standing. Analyzing the firm’s trajectory—whether upward, indicating growth, or experiencing downturns—offers valuable context, even without a specific net worth figure. Including a chart visualizing Greylock’s performance over time would further enhance this analysis.

The Ethical Landscape of Distressed Debt

Investing in distressed sovereign debt carries ethical complexities. Critics argue that it can exploit vulnerable nations, while proponents emphasize its potential to facilitate positive restructuring. Exploring Humes’ perspective on this debate would illuminate his approach to global finance and the values guiding his investment decisions.

Understanding Humes’ Wealth: Beyond the Numbers

Estimating Humes’ net worth requires examining Greylock Capital Management, the foundation of his wealth. Specializing in emerging markets and distressed debt, Greylock seeks high-potential returns in volatile areas. While precise assets under management figures are not consistently public, Greylock’s track record hints at Humes’ skill in navigating these complex financial waters.

From International Upbringing to Investment Strategy

Humes’ focus on emerging markets may stem from his international background, offering a unique perspective on global financial dynamics. This personal touch suggests his work is driven by more than just financial gain.

Humes’ Impact on Global Finance

Beyond financial success, Humes’ work in distressed debt impacts the stability and recovery of struggling economies. This raises questions about the nature of such investments—whether predatory or a vital lifeline—highlighting the ethical complexities of this field. Some experts believe distressed debt investments can be a double-edged sword, offering restructuring opportunities but also carrying the risk of exploitation. Ongoing research continues to explore these long-term consequences, and our understanding of their impact is evolving.

Hans Humes, president and CIO of Greylock Capital Management, has likely amassed substantial wealth through his career in distressed debt investing. His involvement in Argentinian and Greek sovereign debt restructurings, coupled with his leadership at Greylock, solidifies his standing as a significant figure in international finance. While his exact net worth remains undisclosed, his success clearly indicates notable financial achievements.

Disclaimer: This article provides context and insights into Hans Humes’ probable wealth based on his career and Greylock Capital Management’s performance. It does not claim to definitively state his net worth, as this information is not publicly available.